40 bond price zero coupon

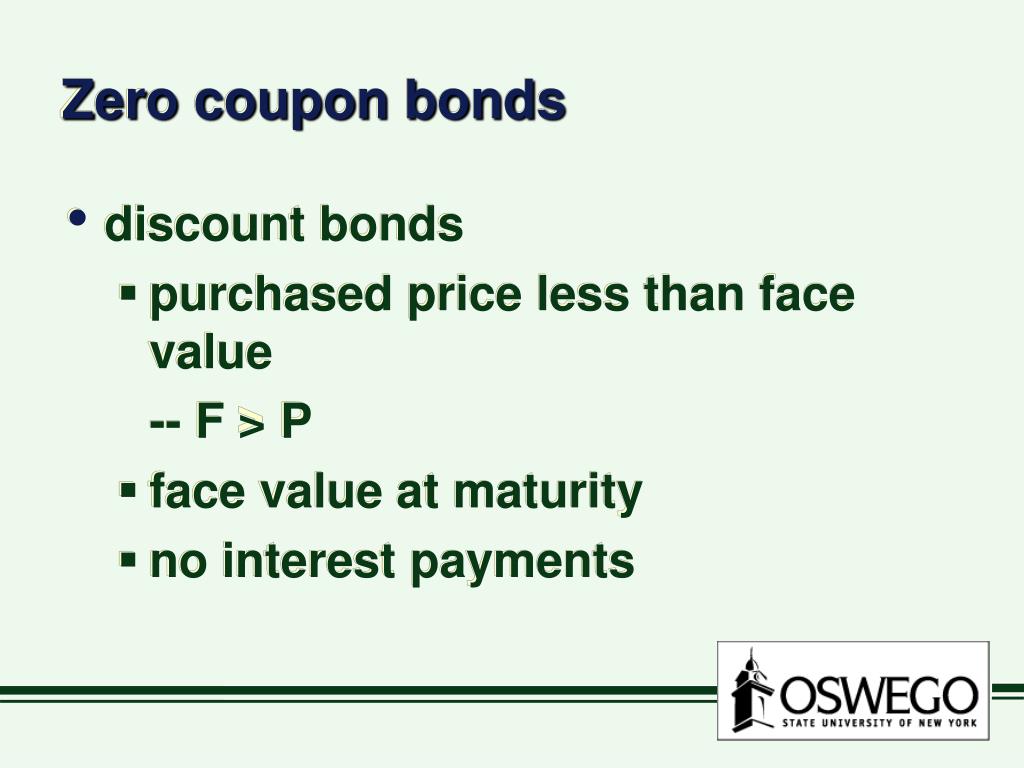

How to Buy Zero Coupon Bonds | Finance - Zacks Step 4. Contact your bank or broker with your zero coupon bond order. The bond selling price remains the same no matter who places your order, but keep in mind that a commission will be added to ... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

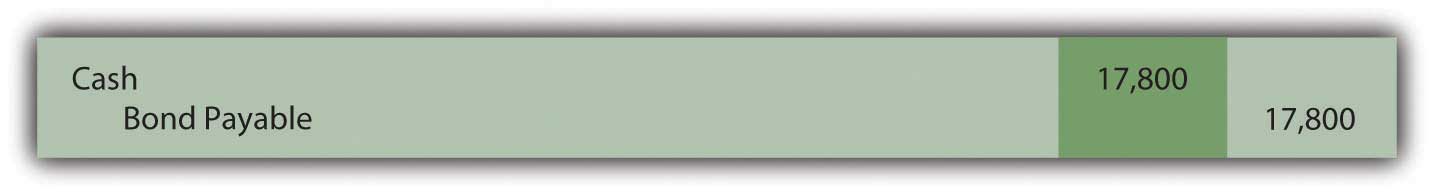

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds. To illustrate, assume that on January 1, Year One, a company offers a $20,000 two-year zero-coupon bond to the public.

Bond price zero coupon

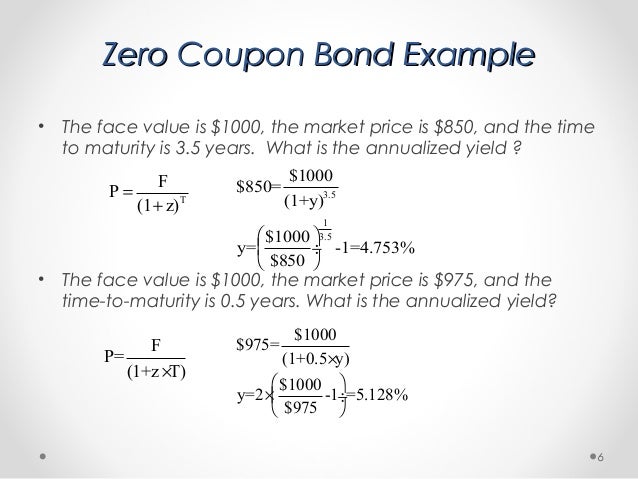

Zero Coupon Bonds - Financial Edge Training Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity. Calculating the value of a zero coupon bond. What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Bond price zero coupon. Pricing a Zero-Coupon Bond - PyAbacus The value of a zero-coupon bond with a par value of 1 at time t and prevailing interest rate r is defined as: $latex P(t)=e^{-rdt}$ Since the interest rate r is always changing, we will rewrite the zero-coupon bond as: $latex P(t)=e^{-\int^T_tr(s)ds}$ The interest rate r is a stochastic process that accounts for the price… What is a Zero Coupon Bond? Who Should Invest? | Scripbox How is the price calculated for a zero coupon bond? The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = (Face value / (1+YTM)^n) - 1 Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10 $2000 6.1917364224 $323.01 Zero Coupon Bond: Definition, Formula & Example - Video ... Invest in a reputable bond mutual fund that provides annual returns of 3%. You deem this to be an acceptable rate of return. Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... What is zero coupon bonds? - Zaviad A zero coupon bond is a debt security that doesn't pay periodic interest payments (coupons) to the bondholder. Instead, the bondholder receives the entire principal amount of the bond at maturity. For this reason, zero coupon bonds are also known as "discount" bonds, since the purchase price is lower than the face value of the bond. Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Price Formula To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula Price of a zero coupon bond - Finance pointers Therefore the price of the zero coupon bond is = $ 5,000 / ( 1 + 0.06 ) 10 = $ 5,000 / ( 1.06 ) 10 = $ 5,000 / 1.790848 = $ 2,791.973885 = $ 2,791.97 ( when rounded off to two decimal places ) The price of the zero coupon bond = $ 2,791.97 Note : ( 1.06 ) 10 = 1.790848 is calculated using the excel function =POWER (Number,Power) Zero Coupon Bond Value Calculator: Calculate Price, Yield ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 ...

Answered: Atlantis Fisheries issues zero coupon… | bartleby Business Finance Q&A Library Atlantis Fisheries issues zero coupon bonds on the market at a price of $435 per bond. If these bonds are callable in 7 years at a call price of $523, what is their yield to call? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

How to Calculate the Price of a Zero Coupon Bond ... Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00.

Government - Continued Treasury Zero Coupon Spot Rates* Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero Coupon) Rates" on the following website: .

Assuming semiannual compounding, what is the price of a zero coupon bond with 11 years to ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Zero-Coupon Bond Price = (as the name suggests, there are no coupon payments) Bond Pricing Calculation (Step by Step) The formula for Bond Pricing calculation by using the following steps: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company. The par value is denoted by F.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

The Zero Coupon Bond: Pricing and Charactertistics ... Calculating the Price of a Zero Coupon Bond The basic math is easy. What should an investor pay for the 1-year coupon? If the investor demands a 4% return over a one-year period, she should pay something around $96 for the $100 maturity value (actually $96.154 since we're starting at less than $100).

Zero-Coupon Bonds: Definition, Formula, Example ... The price of zero-coupon bonds is calculated using the formula given below: See also What Is a Corporate Bond, and How Does It Work? Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

Zero Coupon Bond Calculator - What is the Market Price ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bonds - Financial Edge Training Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity. Calculating the value of a zero coupon bond. What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value.

Post a Comment for "40 bond price zero coupon"