38 coupon paying bond formula

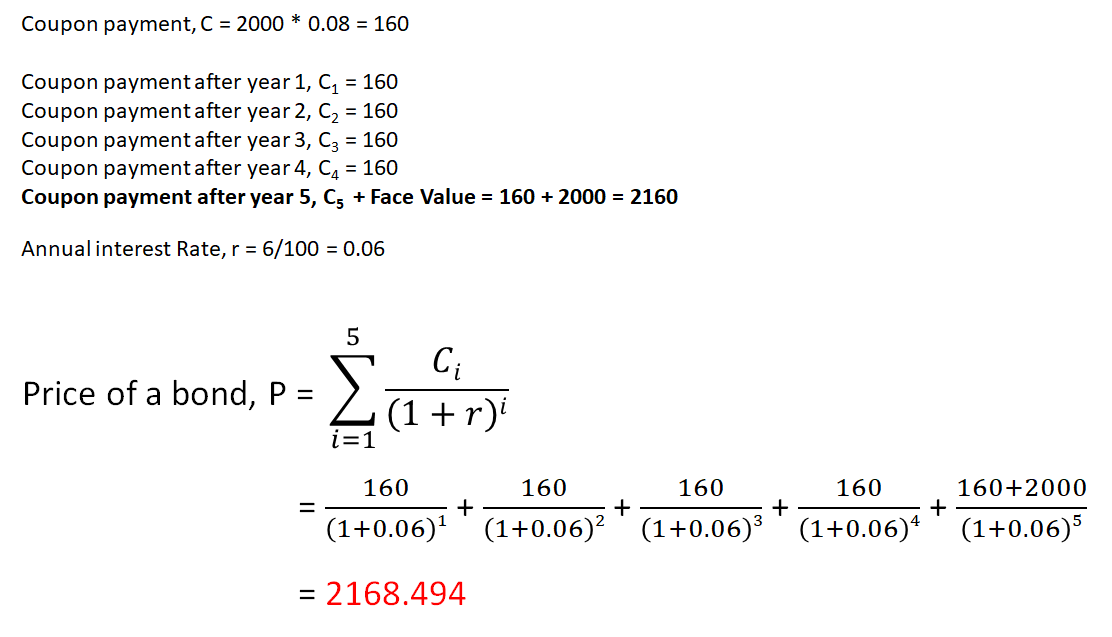

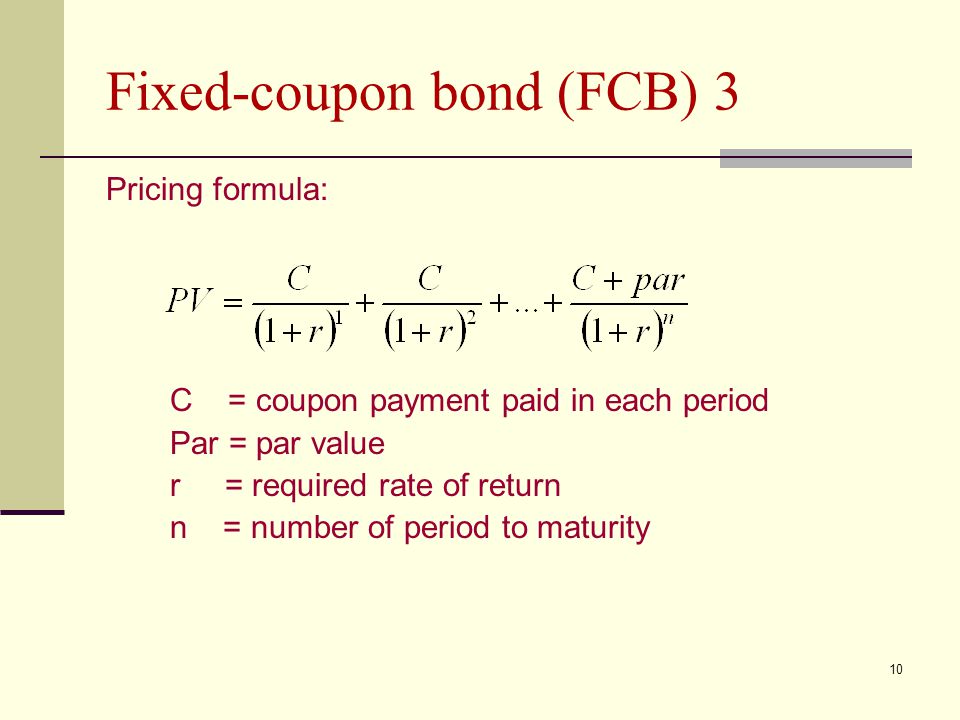

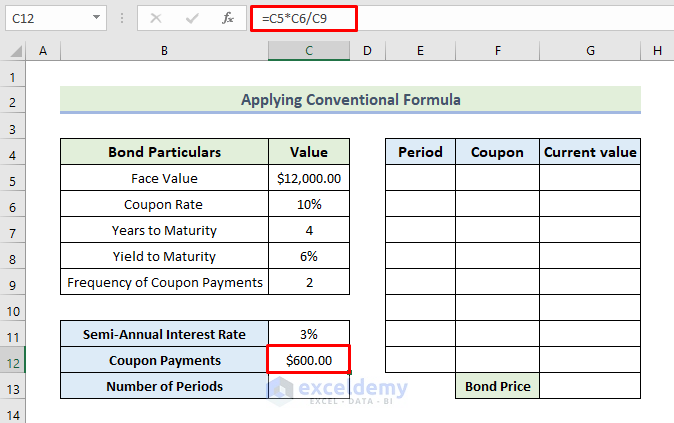

What is the discount factor formula for a coupon paying bond? Answer (1 of 4): You can use different factors depending on what you are discounting from and what you are trying to achieve. Discount factors can be used to price the cashflows of a bond over its maturity from a curve rather than a constant discount factor from a gross redemption yield to matur... Calculate the Value of a Coupon Paying Bond - Finance Train Par Value = $1,000. Yield = 13% annual (13/2 =6.5% semi-annual) Coupon = 12% with semi-annual payment of $60. Maturity = 1 year. The value of the bond is calculated as follows: Note that the coupon is paid semi-annually, i.e., $60 per 6 months. The discounting is also done semi-annually. The general bond pricing formula for all bonds can be ...

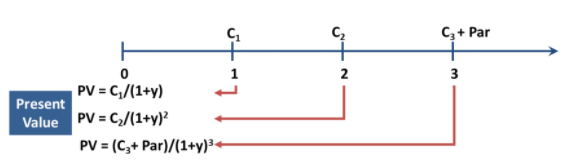

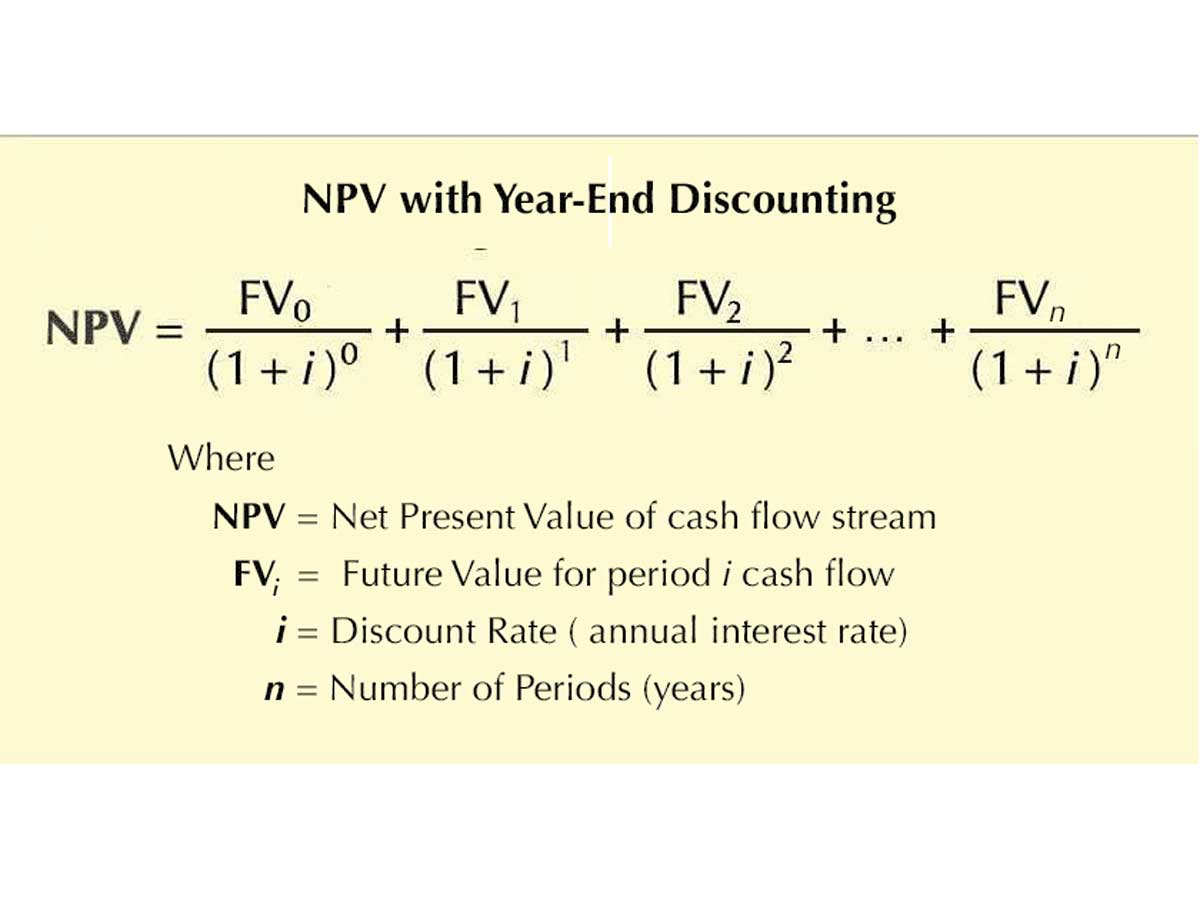

Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ...

Coupon paying bond formula

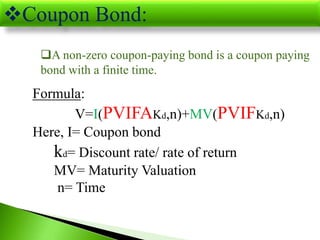

Coupon Payment Bond Formula - uslegalforms.com Coupon Rate Formula — The formula to calculate a bond's coupon rate is very straightforward, as detailed below. Using the bond valuation formulas as just completed above, the value of bond B with a yield of. Show more Gold Award 2006-2018 BEST Legal Forms Company 11 Year Winner in all Categories: Forms, Features, Customer Service and Ease of Use. Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

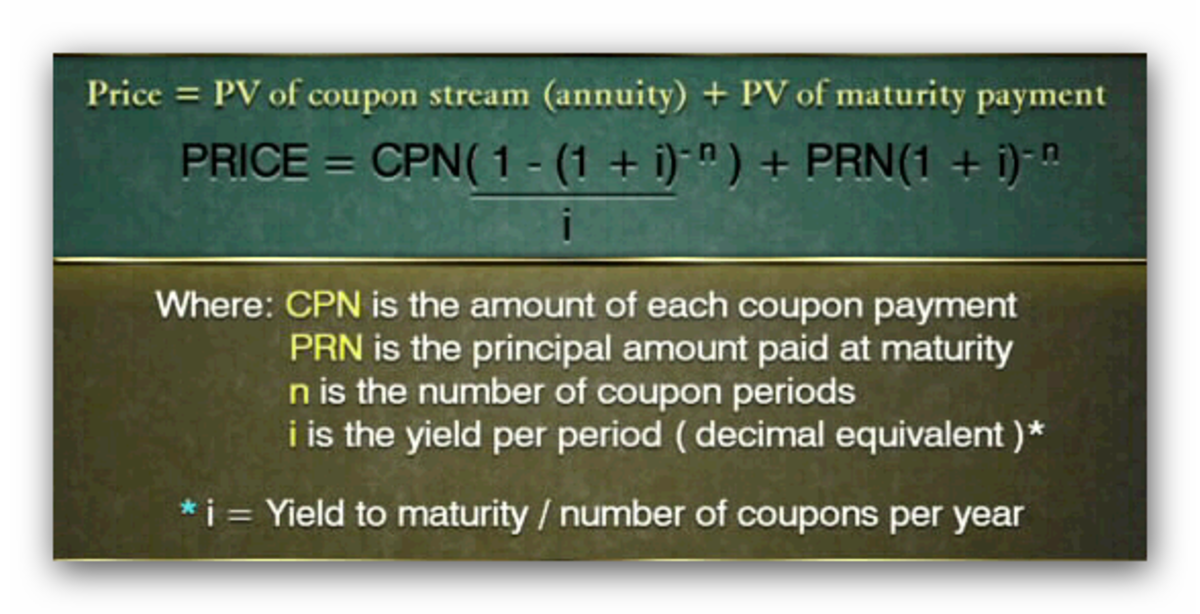

Coupon paying bond formula. Bond Formula | How to Calculate a Bond | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Bond Pricing Formula | How to Calculate Bond Price? | Examples The coupon payment during a period is calculated by multiplying the coupon rate and the par value and then dividing the result by the frequency of the coupon payments in a year. The coupon payment is denoted by C. C = Coupon rate * F / No. of coupon payments in a year Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield. Coupon Rate Calculator | Bond Coupon For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)? Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The formula for CB is derived based on the sum of the present value of all the future cash inflows either in the form of coupons or principal at maturity. The yield to maturity is used to discount the future cash flows to present value. ... Let us take the example of another bond issuance by ZXC Inc., and these bonds pay coupons semi-annually ... Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Bond Yield Formula = Annual Coupon Payment / Bond Price Bond Prices and Bond Yield have an inverse relationship When bond price increases, bond yield decreases. When bond price decreases, bond yield increases. You are free to use this image on your website, templates, etc, Please provide us with an attribution link

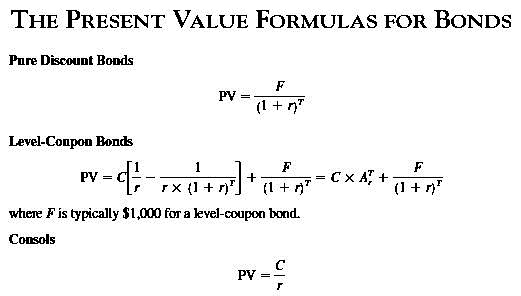

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Coupon Paying Bond Formula The setup is a bit well, a lot of a faff and things do occasionally go slightly wrong but it works properly the vast majority of the time and makes life much easier than mucking around with other coupon paying bond formula remotes and having to point them in the right direction if the devices use IR. Aber nochmal zu deinem Arbeitgeber das ... Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.. You can quickly calculate the coupon payment for each payment period using the coupon payment formula:

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Coupon Bond - Investopedia The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a $1,000...

Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond.

Coupon Payment Bond Formula - uslegalforms.com Coupon Rate Formula — The formula to calculate a bond's coupon rate is very straightforward, as detailed below. Using the bond valuation formulas as just completed above, the value of bond B with a yield of. Show more Gold Award 2006-2018 BEST Legal Forms Company 11 Year Winner in all Categories: Forms, Features, Customer Service and Ease of Use.

Post a Comment for "38 coupon paying bond formula"