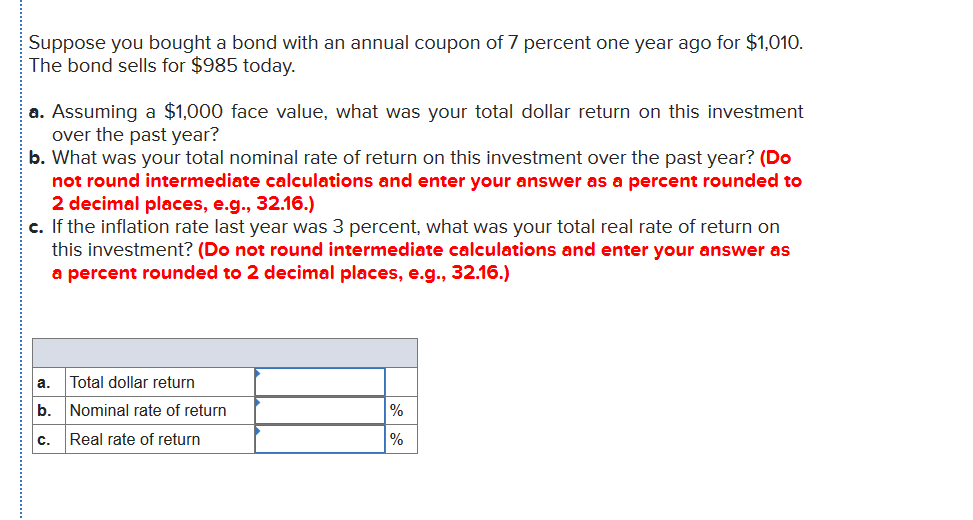

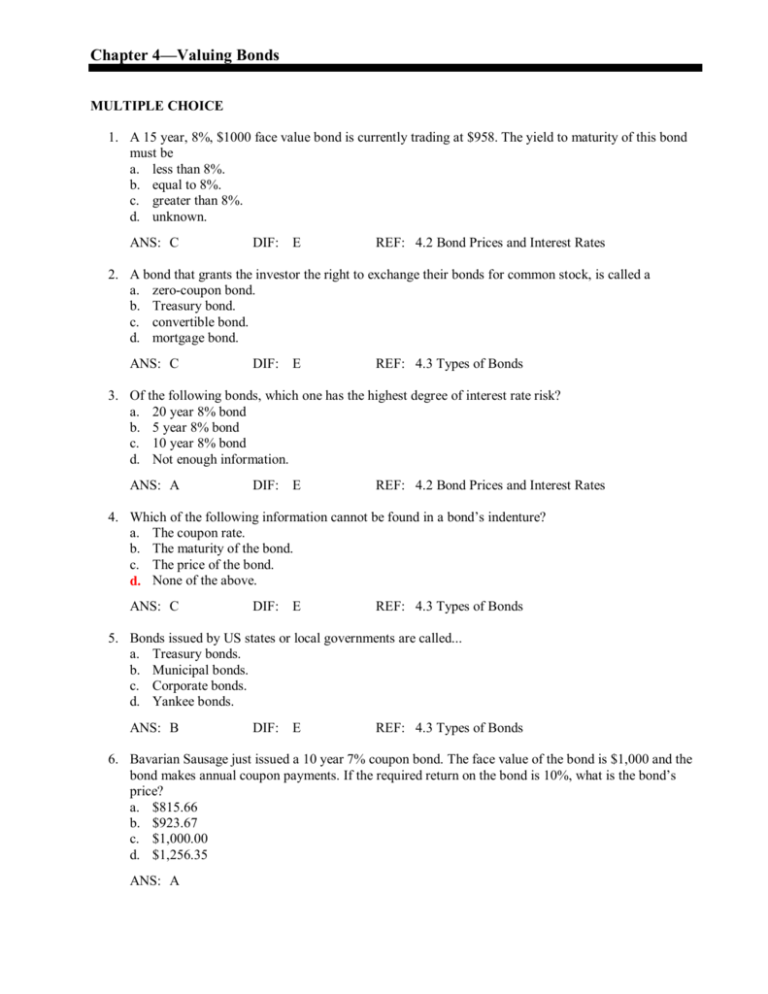

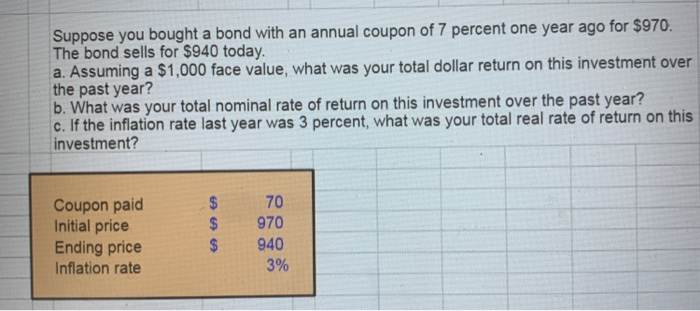

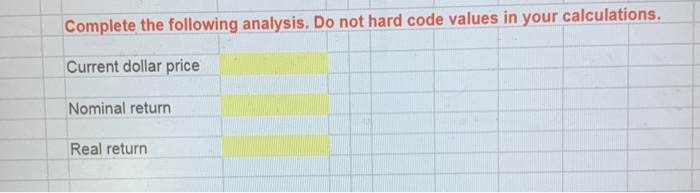

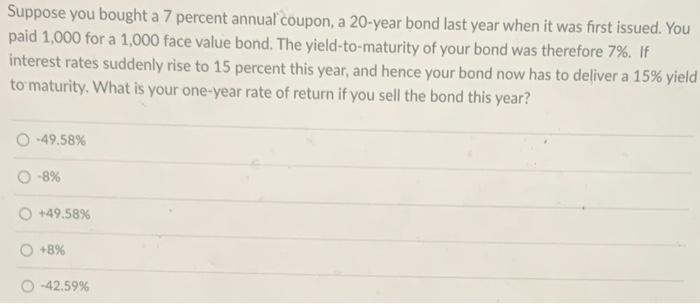

43 suppose you bought a bond with an annual coupon of 7 percent

› 43169301 › Marketing_ManagementMarketing Management - Kotler - Academia.edu Enter the email address you signed up with and we'll email you a reset link. docplayer.net › 14213903-Equity-valuation-lectureEquity Valuation. Lecture Notes # 8. 3 Choice of the ... 4 Investments: Notes 8, c by Yalçın 4 A growth stock is one whose expected rate of return is mainly due to the expected growth of cash flows Conversely a value stock is one whose expected rate of return is mainly due to the expected dividend yield In the case of ConEdison, 993 dividends amounted to $50, or, disregarding compounding issues, an annual dividend of D 0 = 2 Then, we can proxy the ...

Answered: Mario bought a bond with a face amount… | bartleby WebBusiness Accounting Q&A Library Mario bought a bond with a face amount of $1,000, a stated interest rate of 6%, and a maturity date 12 years in the future for $989. The bond pays interest on an annual basis. Three years have gone by and the market interest rate is now 14%. What is the market value of the bond today?

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

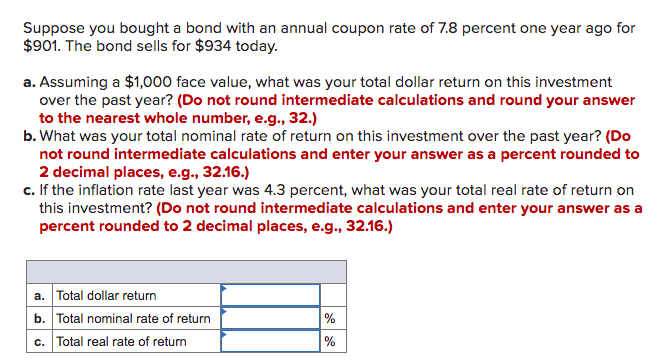

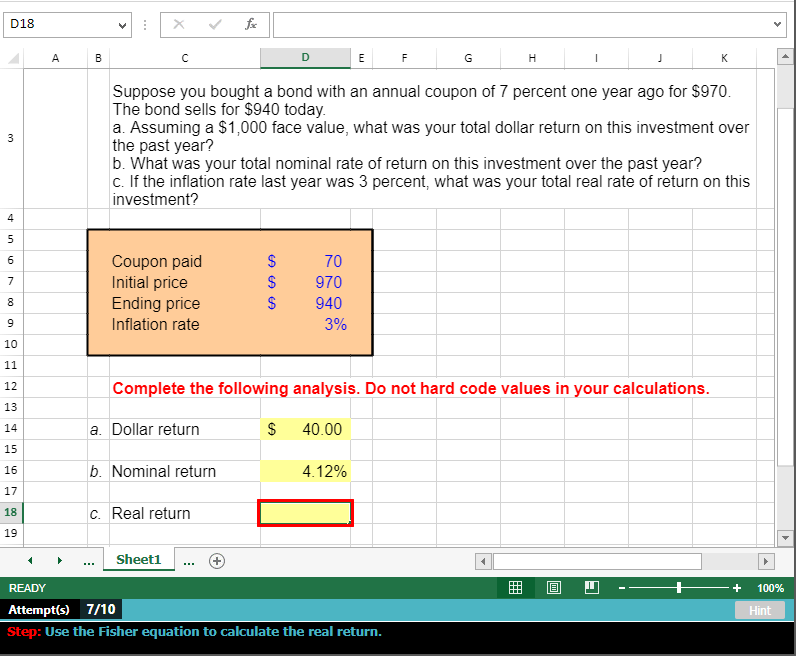

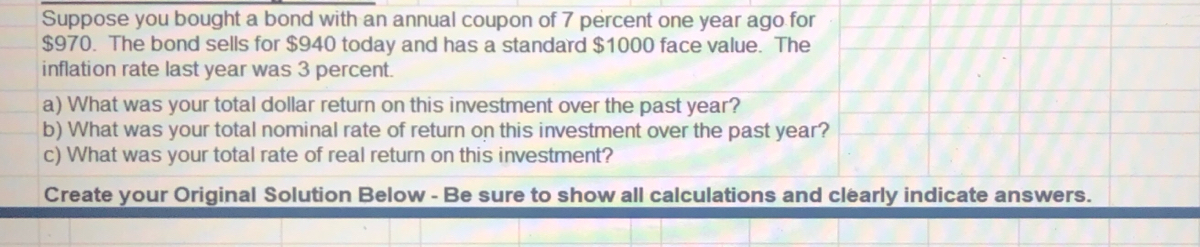

Suppose you bought a bond with an annual coupon of 7 percent

(PDF) Marketing Management - Kotler - Academia.edu WebMarketing Management - Kotler Kotler & Keller Marketing Management, 15th Global Ed. (2016 ... WebKotler & Keller Marketing Management, 15th Global Ed. (2016 ... Pearson Global Edition Kotler_1292092629_mech.indd 1 17/03/15 8:41 PM Marketing Management 15 Global Edition Philip Kotler Northwestern University Kevin ..... to the business from marketing activities and programs, as well as addressing broader concerns and their legal, ethical, … Purchasing Power Parity Formula | Calculator (Excel Template) WebSuppose US dollar is equal to 60 Indian rupees. ( 1$ = 60). Now, consider that an American visited India for the first time. He purchased ten cupcakes for Rs 120. He found the cupcakes cheaper here, as in the US, he had bought similar cupcakes for $3. So here, $3 = 180. For Rs 180, he would be able to buy 15 cupcakes in India. Therefore, the ...

Suppose you bought a bond with an annual coupon of 7 percent. › questions-and-answers › marioAnswered: Mario bought a bond with a face amount… | bartleby Mario bought a bond with a face amount of $1,000, a stated interest rate of 6%, and a maturity date 12 years in the future for $989. The bond pays interest on an annual basis. Free Simple Savings Calculator | InvestingAnswers If you save $200 a month for 30 years - with a 7% return on your money each year - you would enter the following information: Enter "$5,000" as your Current Amount Saved. "$200" as the Monthly Savings Amount "30" as the Number of Years "7%" as the Annual Rate of Return. Equity Valuation. Lecture Notes # 8. 3 Choice of the Appropriate ... Web4 Investments: Notes 8, c by Yalçın 4 A growth stock is one whose expected rate of return is mainly due to the expected growth of cash flows Conversely a value stock is one whose expected rate of return is mainly due to the expected dividend yield In the case of ConEdison, 993 dividends amounted to $50, or, disregarding compounding issues, an … Loans, Yield to Maturity - BrainMass Discount rate annually= 10.00% annual Discount rate per period= 0.8333% n= 48 r= 0.8333% PVIFA (48 periods, .8333% rate ) = 39.428459 Annuity x PVIFA = $8,000 or Annuity = $202.90 =$8,000 / 39.428459 Answer: Monthly payment= $202.90 This can also be solved using excel function PMT ($202.90) =PMT (10%/12,48,8000)

Calc Gain Stock [37YUNS] use this 100% unique product cost template to compile product costings for an unlimited number of manufactured products step 1: enter your dividend stock's symbol last updated december 2, 2020 for example, you purchase a stock at $100 and in a year you sell this stock for $150, your capital gain is $50 for example, you purchase a stock at $100 … Current 90 Day Libor Rate Today's Interest Rates Index - Bankrate 3 Month LIBOR Rate. 3.08. 2.81. 0.12. What it means: LIBOR stands for London Interbank Offered Rate. It's the rate of interest at which banks offer to lend money to one another in the wholesale ... Us Weekly: Latest Celebrity News, Pictures & Entertainment Get today's top celebrity news, celebrity photos, style tips, exclusive video, and more on UsMagazine.com, the official website of Us Weekly. Personal Loan EMI - The Economic Times Here, P= Principal loan amount, R= Rate of interest, n= Number of monthly instalments. An example: Assuming, P= Rs 3 lakh, R= 15 percent per annum= 15/12= 1.250 per month, N= 60 months EMI = = ( (300000*1.250/100* (1+1.250/100)^60/ ( (1+1.250/100)^60-1))) = Rs 7,137 NEWS ON Personal Loan

Need help with finance home owrk - acutetermpapers.com 4. Six years ago, Bradford Community Hosiptal issued 20 year municipal bonds with a 7 percent annual coupon rate. the bonds were called today for a $70 call premium that is, bondholders received $1,070 for each bond. what is the relized rate of return for those investors who bought the bonds for $1,000 when they were issued? Economics Archive | September 22, 2022 | Chegg.com Rent/Buy Read Return Sell. Study ... 24/7 Study Help. Answers in a pinch from experts and subject enthusiasts all semester long Subscribe now. Economics Archive: Questions from September 22, 2022. A company wants to make a single deposit now so it will have \( \$ 56,320 \) five years from now. If the account will earn interest of \( 10 ... Hip2Save Deals, 75% Off Coupons, & Product Reviews l Name Brands at Hot ... We share the hottest online deals, printable coupons, product reviews and promo codes for Amazon, Target, Walmart, Kohl's, Best Buy, CVS, and Walgreens! Shop the best sales now! Also be sure to check back during Black Friday and Cyber Monday for the best online deals! Treasury Return Calculator, With Coupon Reinvestment - DQYDJ The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. (If you are looking for a similar calculator for the S&P 500 with Dividends Reinvested, Gold, or Daily Inflation we've got that too.)

› purchasing-power-parity-formulaPurchasing Power Parity Formula | Calculator (Excel Template) Suppose US dollar is equal to 60 Indian rupees. ( 1$ = 60). Now, consider that an American visited India for the first time. He purchased ten cupcakes for Rs 120. He found the cupcakes cheaper here, as in the US, he had bought similar cupcakes for $3. So here, $3 = 180. For Rs 180, he would be able to buy 15 cupcakes in India.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

Home | MyRSU The Rogers County College Fair is a high school invite-only event. Rogers State University will host more than 40 in and out-of-state colleges and universities in one location. Each collegiate representative will answer student questions regarding entrance requirements, applications, scholarships, and campus life.

What Is the Face Value of a Bond? - SmartAsset A bond's coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond's face value on its maturity date.

en.wikipedia.org › wiki › Shared_appreciation_mortgageShared appreciation mortgage - Wikipedia For instance, suppose the current prevailing interest rate is 6%, and the property was purchased for $500,000. The borrower puts down $100,000 and takes out a mortgage of $400,000 amortized over 30 years. The lender and the borrower agree to a lower interest rate of 5%, and to a contingent interest of 20% of appreciated value of the property.

This Inflation Will Be Tough to Get under Control | Wolf Street It's still just lowering the amount of fuel it's pouring on the inflation fire. The top end of the Fed's target range for the federal funds rate is currently 2.5% [update: as of Wednesday, it's 3.25%], and with inflation over 8%, the Fed is still pouring huge amounts of fuel on the fire.

Fantasy News, Player Stats, Rumors and Rankings - CBSSports.com WebStay at the top of your fantasy leagues with CBS Sports. Your source for in-depth fantasy sports news, stats, scores, rumors, and strategy.

FRB H15: Data Download Program - Choose - Federal Reserve Download file. Select a preformatted data package. Treasury Constant Maturities [csv, All Observations, 914.7 KB ] Weekly Averages (Fed Funds, Prime and Discount rates) [csv, Last 52 Obs, 1.9 KB ] Weekly Averages [csv, Last 52 Obs, 11.9 KB ] Monthly Averages [csv, Last 12 Obs, 6.6 KB ] Download all H15 data as a single XML file [SDMX/ZIP, 4.0 MB]

Nasdaq Annual Average Return [DVY531] While Return on investment total ranking has deteriorated compare to previous Income investors make a big mistake by placing to much emphasis on dividend yield Bond Baa Corporate Bond: S&P 500 (includes dividends)3: 3-month T 12)1 / 4 - 1 or 1 Though S & P 500 annual returns, on average, from 1950 to 2018 was 8 How To Make A Tnt Duplicator ...

(PDF) General Mathematics Learner's Material Department of … WebThis learning resource was collaboratively developed and reviewed by educators from public and private schools, colleges, and/or universities. We encourage teachers and other education stakeholders to email their feedback, comments and

WEEK 1-18 - Studylib WebFree essays, homework help, flashcards, research papers, book reports, term papers, history, science, politics

US Inflation Rate by Year: 1929-2023 - The Balance The Federal Reserve ("the Fed") considers this an acceptable rate of inflation. 1 On August 27, 2020, the Fed announced that it would allow a target inflation rate of more than 2% if that will help ensure maximum employment. It still seeks a 2% inflation over time but is willing to allow higher rates if inflation has been low for a while. 2

'Bloomberg Daybreak: Middle East' Full Show (09/22/2022) September 22nd, 2022, 12:55 AM PDT. "Bloomberg Daybreak: Middle East" live from Dubai, connects Asian markets to the European opens. The show focuses on global macro issues with a Middle Eastern ...

Calculator Cost Carrying Annual [1FO7SK] Search: Annual Carrying Cost Calculator. Organizations typically define their own "cost of capital" in one of two ways: Firstly, "Cost of capital" is merely the financing cost the organization must pay when borrowing funds, either by securing a loan or by selling bonds, or equity financing 25 standard emails x 4 g CO2e = 121 g CO2e There are a number of accepted methods and the method of ...

› questions-and-answers › aAnswered: A corporate bond maturing in 15 years… | bartleby Q: The 7 percent annual coupon bonds of the ABC Co. are selling for $950.41. The bonds mature in 8… The bonds mature in 8… A: Yield to maturity is the rate of return a bond generates in its lifetime assuming to be held till…

How to Invest in Bonds - The Motley Fool The second way to profit from bonds is to sell them at a price that's higher than you initially paid. For example, if you buy $10,000 worth of bonds at face value -- meaning you paid $10,000 -- and...

Best Amortization Schedule Calculator | InvestingAnswers If you're looking to determine your amortization schedule with fixed monthly payments, our amortization schedule calculator can help. Say that you're going to borrow $300,000 at 5% for 30 years. Enter: "$300,000" as the Mortgage Amount "30" as the Term, and "5" as the Annual Interest Rate.

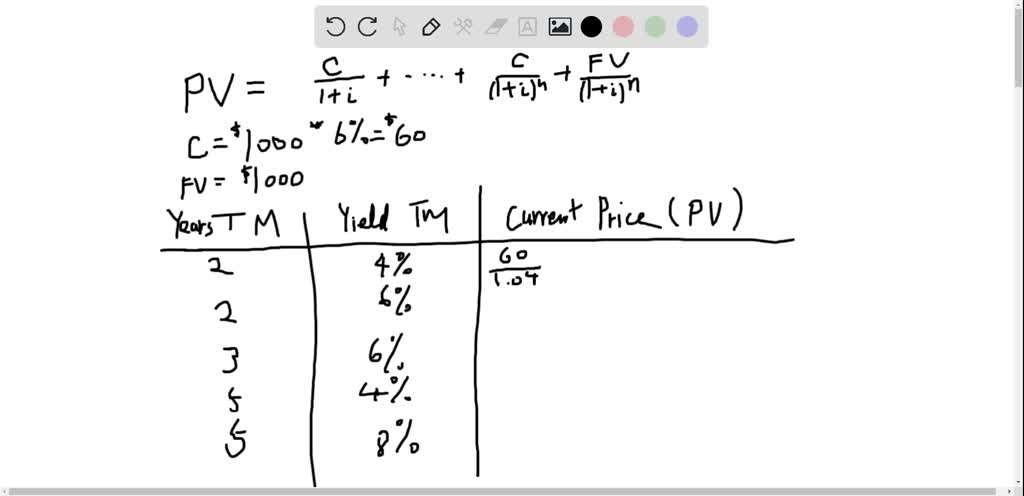

consider a bond with a 6 annual coupon and a face value of 1000 complete the following table what re

35 Easy Ways to Save Income Tax in India (Updated for FY 2020-2021) Any proceeds received on account of maturity or amount received as bonus of an insurance policy is exempt from tax only if the premium paid does not exceed 20% of the sum assured. For example, if the annual premium is Rs 10,000, to qualify for the exemption, the minimum sum assured under the policy is required to be Rs 50,000.

10-Year T-Note Overview - CME Group Specs. Margins. Calendar. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis ...

Simple vs. Compound Interest - The Motley Fool If you borrow $1,000 and pay a simple interest rate of 7% for five years, then you would pay a total of $350 in simple interest on the debt. If you invest $10,000 in a bond that pays a 5% coupon,...

› 38857728 › Principles_ofPrinciples of Managerial Finance by Gitman - Academia.edu Enter the email address you signed up with and we'll email you a reset link.

Economics Archive | September 22, 2022 | Chegg.com Rent/Buy Read Return Sell. Study Expert Q&A Textbook Solutions Math Solver Citations Plagiarism checker Grammar checker Expert proofreading. Career Bootcamps Internships Career advice. Life Home. home / study / business / economics / economics questions and answers / september 2022 / 22 ...

Answered: A corporate bond maturing in 15 years… | bartleby WebQ: The 7 percent annual coupon bonds of the ABC Co. are selling for $950.41. The bonds mature in 8… The bonds mature in 8… A: Yield to maturity is the rate of return a bond generates in its lifetime assuming to be held till…

Dividend Yield - BrainMass Rick bought a bond when it was issued by Macroflex Corporation 14 years ago. The bond, which has a $1,000 face value and coupon rate equal to 10 percent, matures in six years. Interest is paid every six months; the next interest payment is scheduled for six months from today. If the yield on similar-risk investments is 14 pe

2023 Recruit Football Team Rankings - 247Sports The Formula; where c is a specific team's total number of commits and R n is the 247Sports Composite Rating of the nth-best commit times 100.; Explanation; In order to create the most ...

UOTeam: Home The Team Member Dining team is always cooking up something new for you to try! Below are the updated hours of operation for the impacted Team Member Dining locations (effective immediately): Backlot Bistro: 5:00am-3:00am, every day. Hollywood Mini Grill: 10:00am-one hour before park close, every day. B112 Mini Grill: 11:00am-6:00pm, every day.

Purchasing Power Parity Formula | Calculator (Excel Template) WebSuppose US dollar is equal to 60 Indian rupees. ( 1$ = 60). Now, consider that an American visited India for the first time. He purchased ten cupcakes for Rs 120. He found the cupcakes cheaper here, as in the US, he had bought similar cupcakes for $3. So here, $3 = 180. For Rs 180, he would be able to buy 15 cupcakes in India. Therefore, the ...

Kotler & Keller Marketing Management, 15th Global Ed. (2016 ... WebKotler & Keller Marketing Management, 15th Global Ed. (2016 ... Pearson Global Edition Kotler_1292092629_mech.indd 1 17/03/15 8:41 PM Marketing Management 15 Global Edition Philip Kotler Northwestern University Kevin ..... to the business from marketing activities and programs, as well as addressing broader concerns and their legal, ethical, …

(PDF) Marketing Management - Kotler - Academia.edu WebMarketing Management - Kotler

Post a Comment for "43 suppose you bought a bond with an annual coupon of 7 percent"