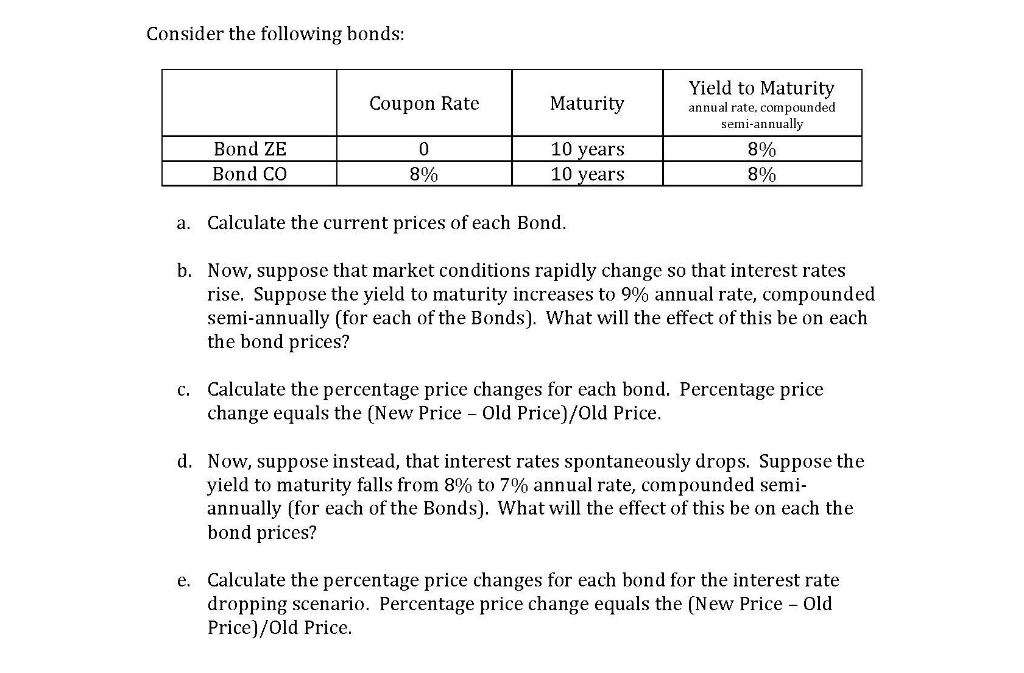

42 how to calculate coupon rate from yield

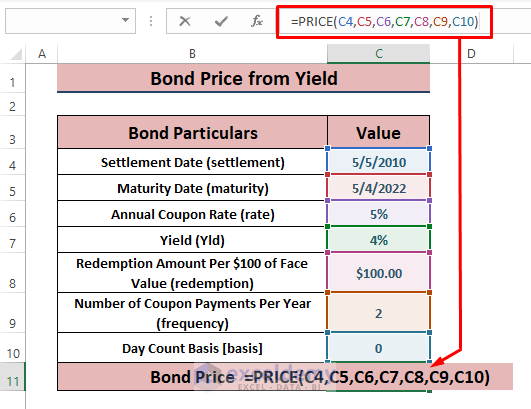

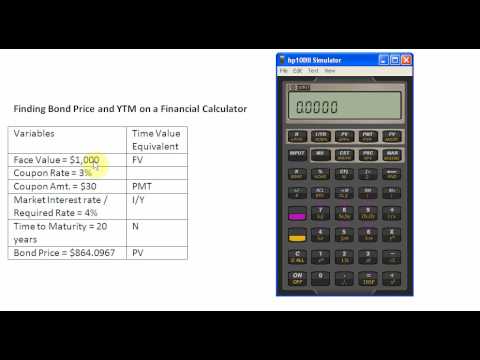

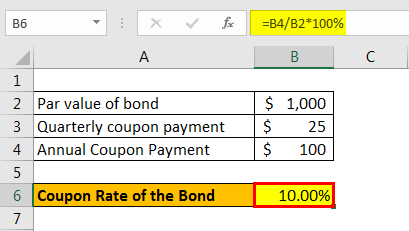

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Aug 02, 2020 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · Find out how to use Microsoft Excel to calculate the coupon rate of a bond using its par value and the amount and frequency of its coupon payments. ... enter the formula "=A3/B1" to yield the ...

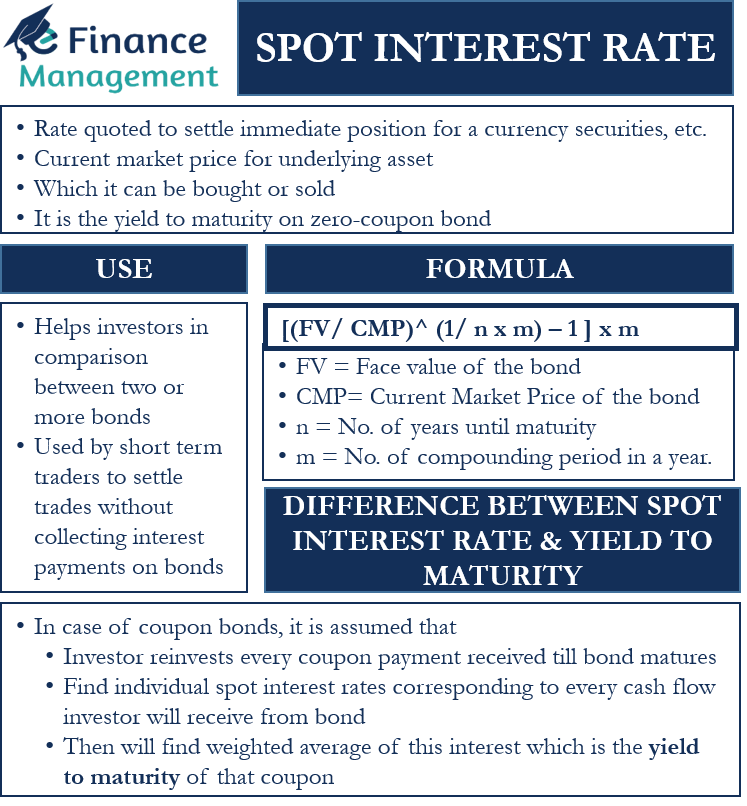

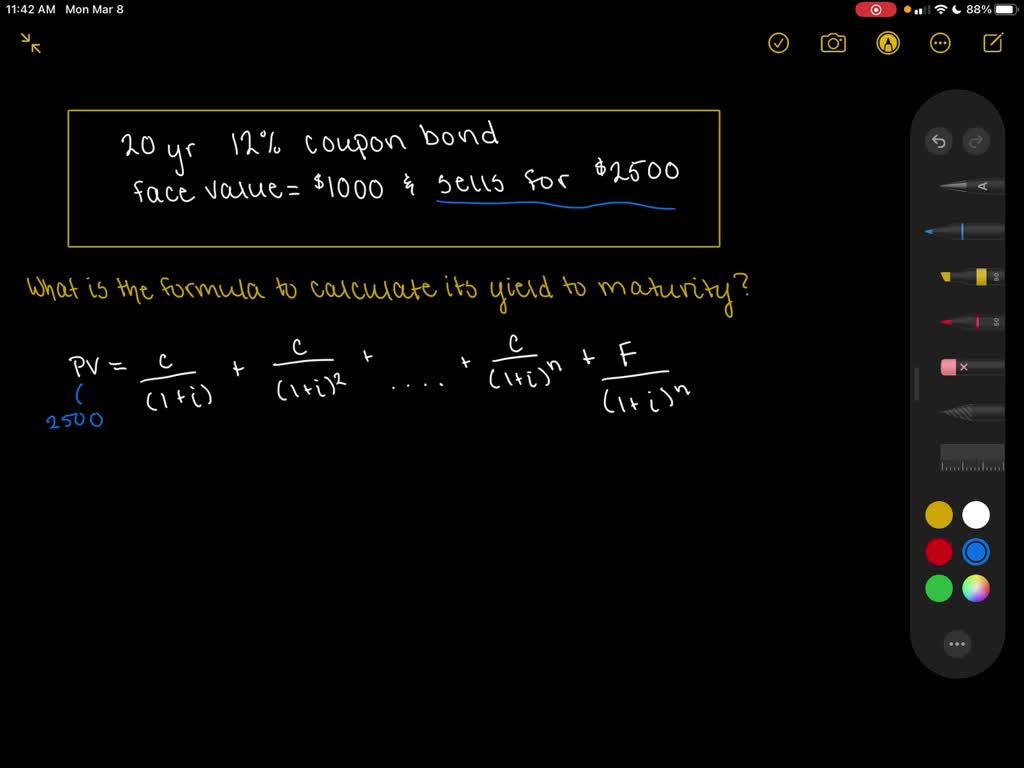

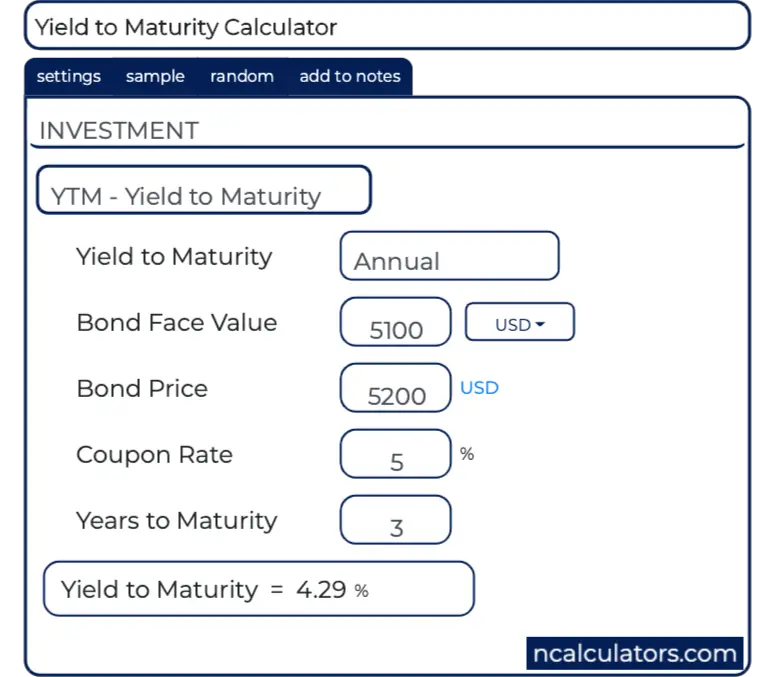

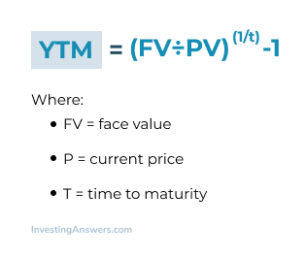

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

How to calculate coupon rate from yield

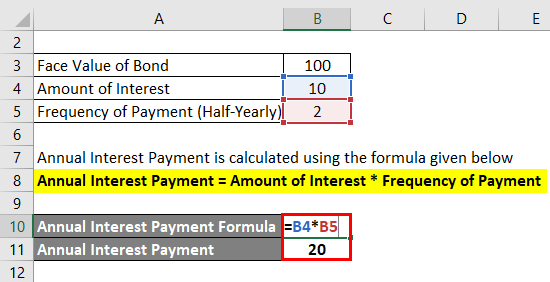

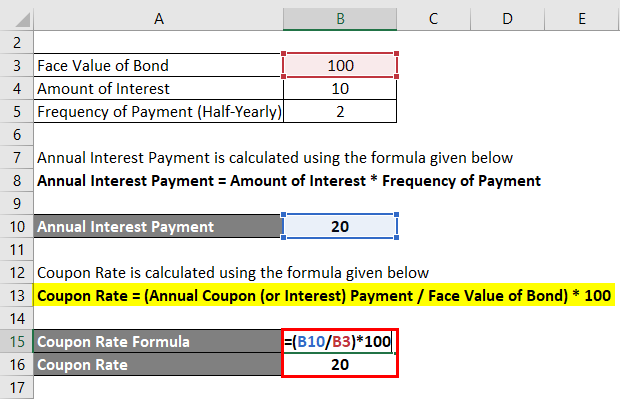

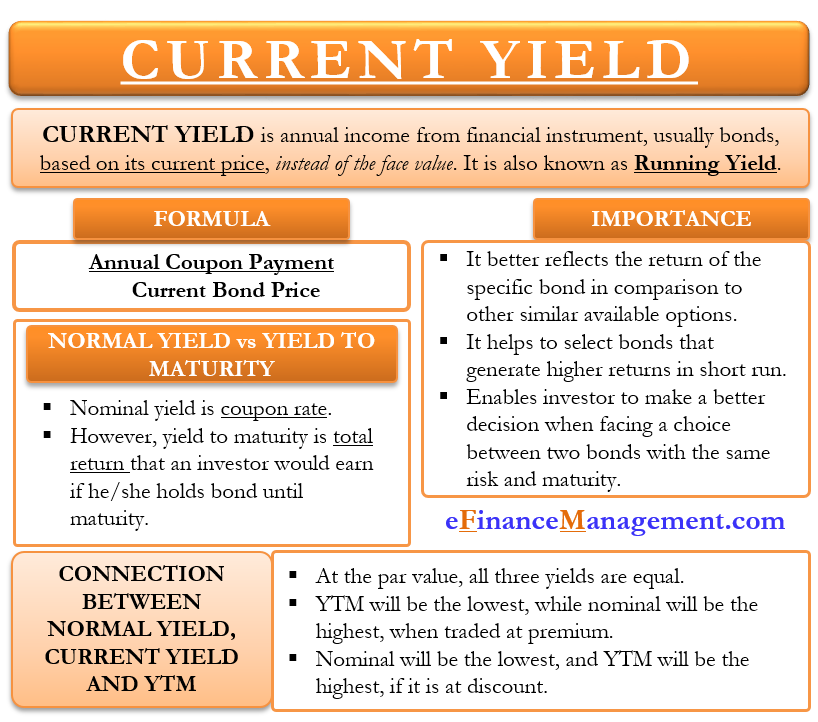

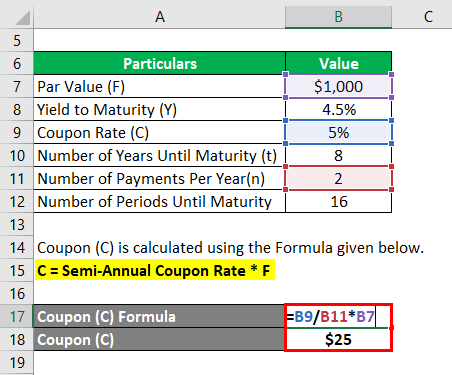

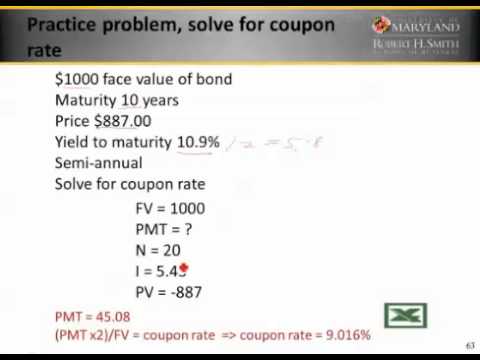

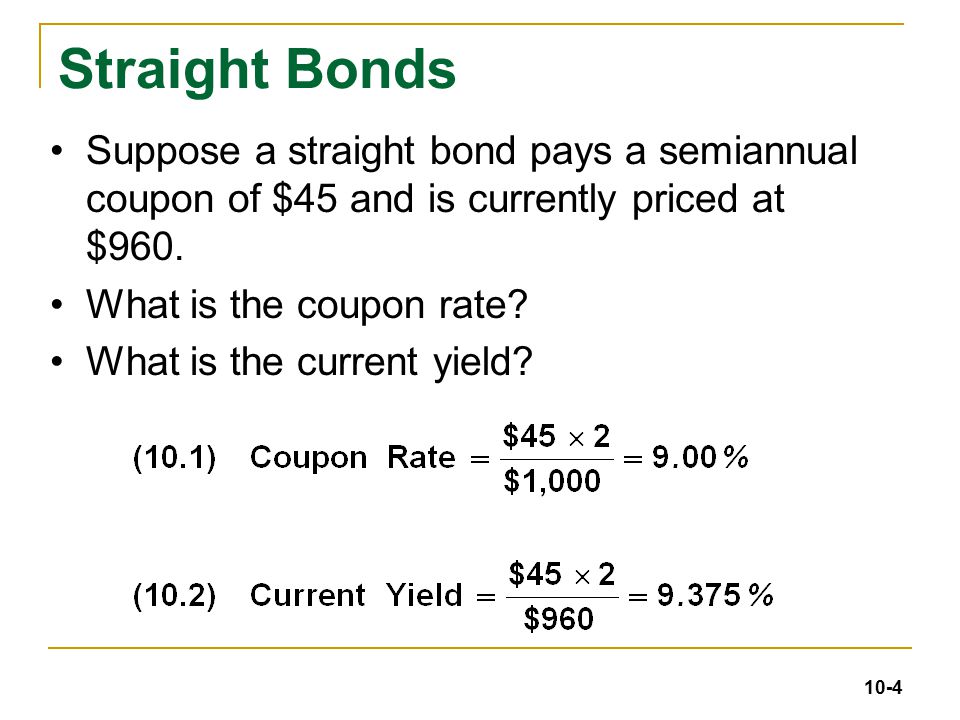

Current Yield Calculator | Calculate Current Yield of a Bond Current Yield Definition. Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... How to Calculate Current Yield (Formula and Examples) Jan 03, 2022 · Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ...

How to calculate coupon rate from yield. How to Calculate Bond Yield in Excel: 7 Steps (with Pictures) Mar 29, 2019 · Enter the following values in the corresponding cells to test the functionality of the bond yield calculator. Type 10,000 in cell B2 (Face Value). Type .06 in cell B3 (Annual Coupon Rate). Type .06 in cell B3 (Annual Coupon Rate). Type .09 into cell B4 (Annual Required Return). Type 3 in cell B5 (Years to Maturity). Type 1 in cell B6 (Years to ... How to Calculate Current Yield (Formula and Examples) Jan 03, 2022 · Coupon rate = (total annual coupon payment / par value of bond) x 100. Example: A bond with a face value of $200 and a $5 coupon has a coupon rate of 2.5% because ($5 / $200) x 100 = 2.5%. Nominal yield vs. yield to maturity. Nominal yield is another name for the coupon rate. The yield to maturity is the total return you earn if you hold the ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Current Yield Calculator | Calculate Current Yield of a Bond Current Yield Definition. Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Post a Comment for "42 how to calculate coupon rate from yield"