39 payment coupon for irs

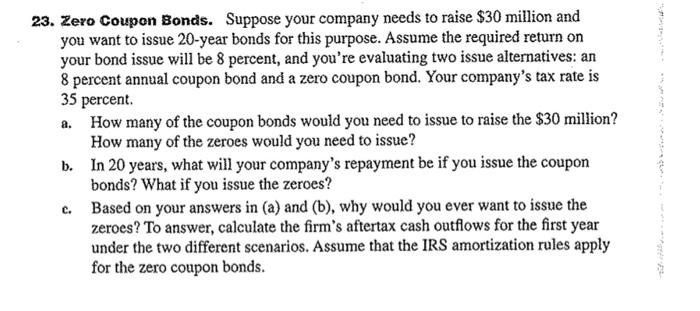

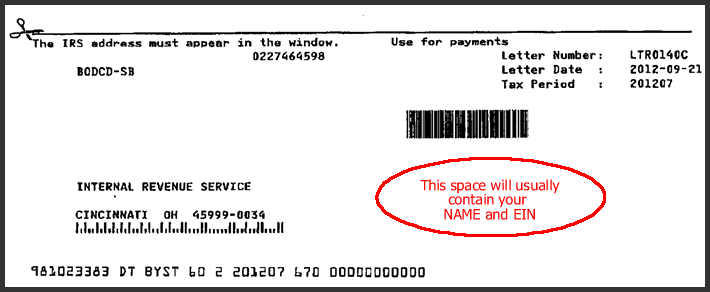

Paying a Balance Due (Lockbox) for Individuals - IRS The IRS uses lockboxes which are a collection and processing service provided by a network of financial institutions. Use your Form 1040-V, Payment Voucher. Make a Payment | Minnesota Department of Revenue You can make payments for taxes and fees online, from your bank account, or in person. If you received a bill from the Minnesota Department of Revenue and cannot pay in full, you may request an installment plan. For more information, see Payment Agreements. Bank Account [+] ACH Credit [+] Check or Money Order [+] Credit or Debit Card [+] Cash [+]

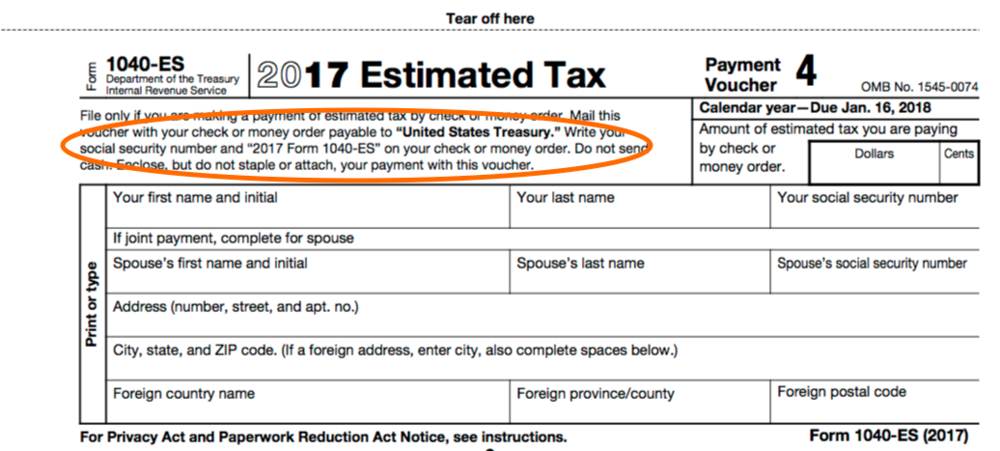

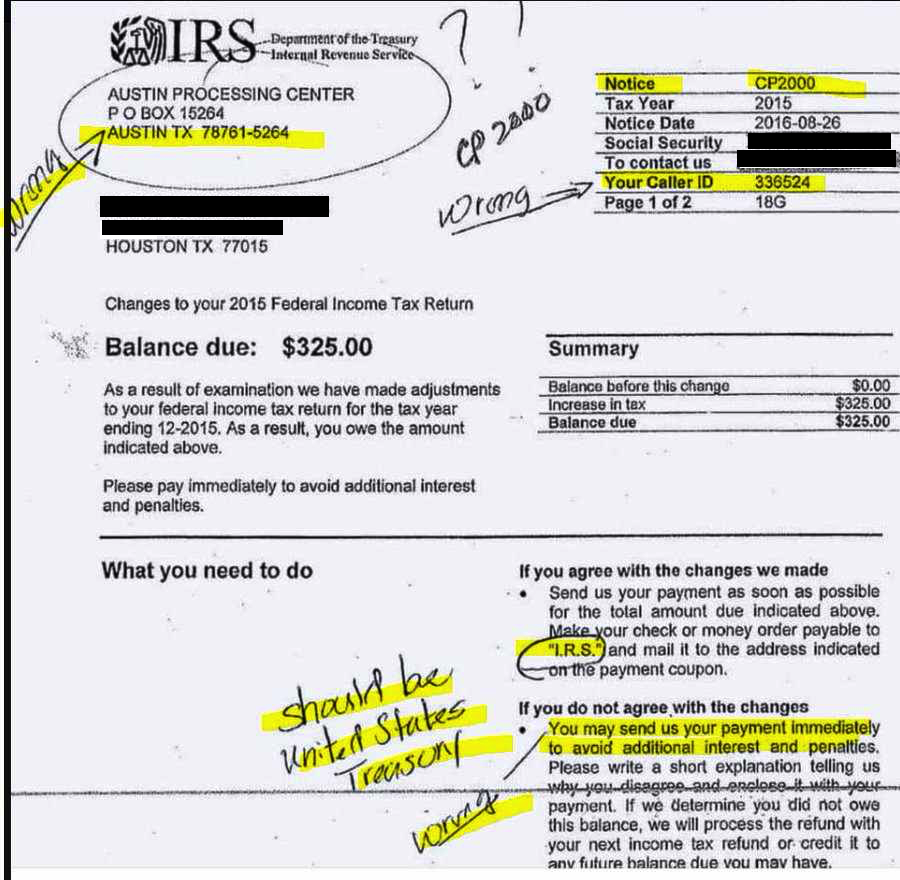

Form 941-V, Payment Voucher - REGINFO.GOV Payment Voucher. . Don't staple this voucher or your payment to Form 941. OMB No. 1545-0029. 2017. 1. Enter your employer identification number (EIN). 2. Enter the amount of your payment. . Make your check or money order payable to "United States Treasury" Dollars. Cents3. Tax Period. 1st Quarter 2nd Quarter. 3rd Quarter 4th Quarter. 4

Payment coupon for irs

PDF 2022 Form 1040-V - IRS tax forms Payment Voucher. Do not staple or attach this voucher to your payment or return. Go to for payment options and information. IRS reminds taxpayers IRS Free File remains open until Nov. 17 IR-2022-199, November 15, 2022. WASHINGTON — The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free File remains open until November 17 and can help those who qualify claim the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit.. These and other tax benefits were expanded under last year's American Rescue Plan Act and ... 2019 Form 1040-V - IRS Form 1040-V. Department of the Treasury. Internal Revenue Service (99). Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return.

Payment coupon for irs. 2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms - Illinois Withholding (Payroll) Tax Forms 2022 IL-501 Payment Coupon Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL-501 online Click here to download the PDF payment coupon Payment Vouchers | Arizona Department of Revenue - AZDOR Payment Vouchers Form is used those who electronically files a tax return and is separately mailing payment for taxes not remitted with the tax form, when filed. Form 941-V Payment Voucher - Taxbandits You can only use payment voucher Form 941-V if your total taxes for the current or previous quarter are less than $2,500, you didn't incur a $100,000 next-day deposit obligations during the current tax quarter, and you're paying the amount you owe in full by the deadline. You can also use payment voucher 941-V if you are a monthly scheduled ... 3 Ways to Set Up a Payment Plan with the IRS - wikiHow Businesses are eligible for long-term payment plans if they owe less than $25,000. If you owe more than $50,000 but less than $100,000, you are only eligible for a short-term payment plan. Generally, you must pay the full amount you owe to the IRS in less than 120 days. 2 Gather the information you'll need to apply online.

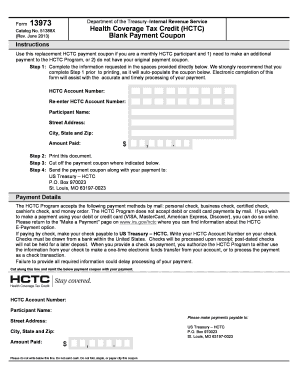

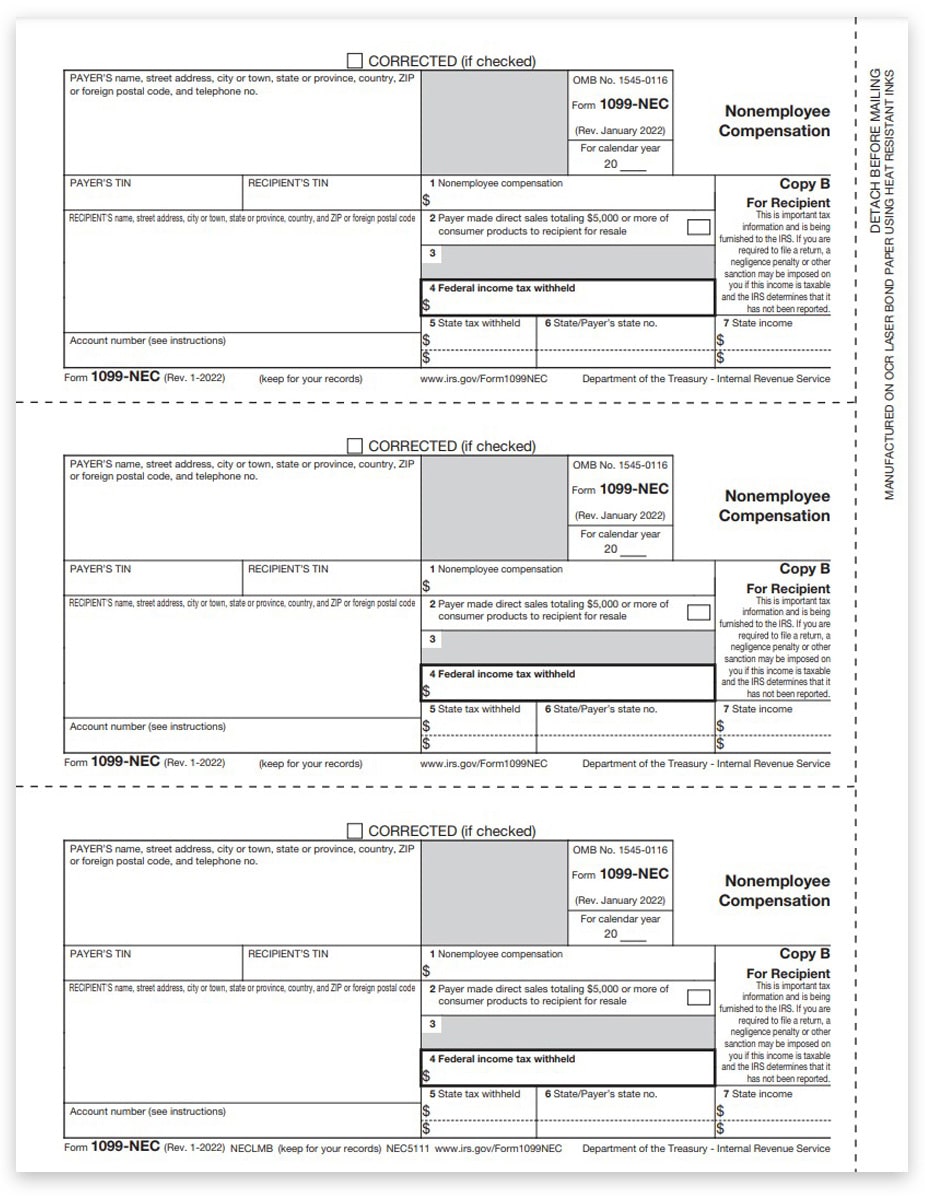

Health Coverage Tax Credit (HCTC) Blank Payment Coupon - IRS Instructions. Use this HCTC payment coupon if you received a notification letter from the IRS stating you have successfully enrolled in the HCTC Program. Free 1040 Tax Return Irs Form 1040 V Payment Voucher 2022 You can easily access coupons about "Free 1040 Tax Return Irs Form 1040 V Payment Voucher 2022" by clicking on the most relevant deal below. bestcouponsaving Free 1040 Tax Return Irs Form 1040 V Payment Voucher 2022 100% of the tax shown on your 2021 tax return. Your 2021 tax return must cover all 12 months. CAUTION! a. About Form 1040-ES, Estimated Tax for Individuals - IRS Sep 23, 2022 ... In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable income, such as unemployment ... State of Oregon: Oregon Department of Revenue - Payments Electronic payment from your checking or savings account through the Oregon Tax Payment System. ... Mail check or money order with voucher to: Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050; Cash payments must be made at our Salem headquarters located at:

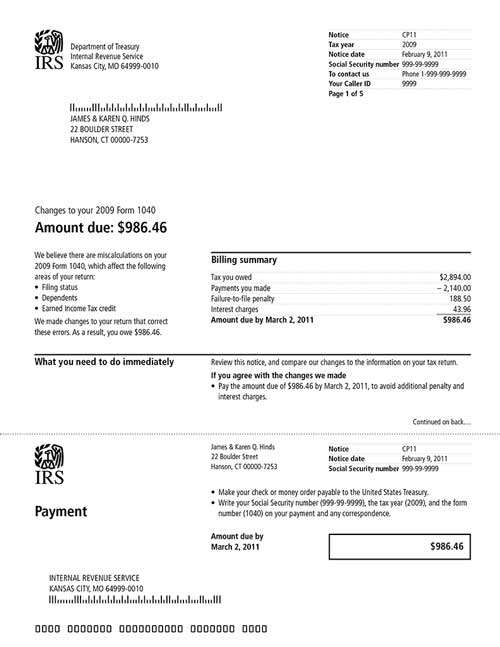

IRS payment options | Internal Revenue Service 2019 Tax Liability - If paying a 2019 income tax liability without an accompanying 2019 tax return, taxpayers paying by check, money order or cashier's check should include Form 1040-V, Payment Voucher with the payment. Mail the payment to the correct address by state or by form. Do not send cash through the mail. Form 1040-V: Payment Voucher Definition - Investopedia The payment voucher at the bottom of Form 1040-V should be detached and mailed with your tax return and payment. The voucher asks for four main pieces of information. Line 1: Your Social... Prior Year Products - IRS tax forms Payment Voucher 1997 Form 1040-V: Payment Voucher 1996 Form 1040-V: Payment Voucher 1995 Form 1040-V: Payment Voucher 1994 « Previous | 1 | Next » Get Adobe ® Reader ... IRS Payment Options With a 1040-V Payment Voucher - The Balance As of the 2020 tax year, it ranges from $31 to $225, depending on how you make your payment. There are options and reduced fees available to low-income taxpayers who qualify. This is a one-time fee that's paid upfront. It is often part of your first payment. 4 You can apply for an installment agreement on the IRS website if you owe $50,000 or less.

Payments | Internal Revenue Service - IRS tax forms View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account Pay from Your Bank Account For individuals only. No registration required. No fees from IRS.

Payment Vouchers - Michigan Payment Vouchers Below are the vouchers to remit your Sales, Use and Withholding tax payment (s): 2022 Payment Voucher 2021 Payment Voucher 2020 Payment Voucher 2019 Payment Voucher 2018 Payment Voucher 2017 Payment Voucher 2016 Payment Voucher 2015 Payment Voucher

Irs Estimated Payment Coupon - bizimkonak.com Listing Websites about Irs Estimated Payment Coupon. Filter Type: All $ Off % Off Free Shipping Filter Type: All $ Off % Off Free Shipping Search UpTo % Off: 50% 70% 100% $ Off: $50 $70 $100 . Filter By Time All Past 24 hours Past Week Past Month. Recently Searched › Best ...

PDF 2022 Form 1040-ES - IRS tax forms Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding, you should make estimated tax payments on other

Estimated Taxes | Internal Revenue Service - IRS tax forms Go to IRS.gov/Account . Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax. Using the Electronic Federal Tax Payment System (EFTPS) is the easiest way for individuals as well as businesses to pay federal taxes.

E-file and Payment Options - Department of Revenue - Kentucky Withholding Return And Payment System (WRAPS) Tax Payment Solution (TPS): Register for EFT payments and pay EFT Debits online Return Bulk Filing - Manual Upload Mail a return with check or money order made payable to "Kentucky State Treasurer": Kentucky Department of Revenue Frankfort, KY 40620-0004

7 Ways To Send Payments to the IRS - The Balance EFTPS saves your payment history for up to 16 months. 1 Online by Debit or Credit Card You can pay the IRS by credit or debit card, but you must use one of the approved payment processors. Three processors are available. You can access any of them on the IRS website or through the IRS2Go mobile app: PayUSATax.com Pay1040.com ACI Payments, Inc.

About Form 1040-V, Payment Voucher - IRS tax forms Forms and Instructions About Form 1040-V, Payment Voucher About Form 1040-V, Payment Voucher Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision Form 1040-V PDF Recent Developments None at this time. Other Items You May Find Useful

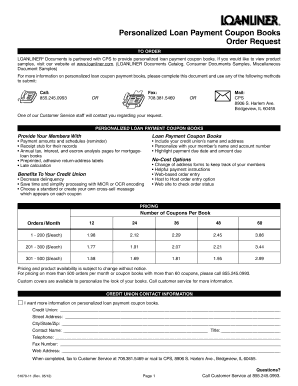

Payment Coupon Templates - 11+ Free Printable PDF Documents Download Payment Coupon Templates - 11+ Free Printable PDF Documents Download A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices.

PDF 2021 Form 770-PMT, Payment Coupon - Virginia Tax For additional information visit or call (804) 367-8031. VIRGINIA DEPARTMENT OF TAXATION FORM 770-PMT - 2021 PAYMENT COUPON Va. Dept. of Taxation 770PMT 2601052 Rev. 06/21 Tax.00 Penalty.00 Interest.00 Amount of Payment.00 Payment Type 770 Return Payment 765 Return Payment Name of Estate, Trust or Pass-Through Entity

What is a Coupon Payment? - Definition | Meaning | Example Twenty years later, Mark earns his last payment of $300, plus his original investment of $10,000. In total, Mark has turned his $10,000 into $13,000 over 10 years, which was a safe, and smart, investment for him. Summary Definition. Define Coupon Payments: Coupon payment means the interest installment paid to bond holders.

Estimated Tax Payment Coupon Irs - bizimkonak.com Category: coupon codes Show All Coupons Estimated tax payments FTB.ca.gov - California CODES (4 days ago) WebGenerally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and … Visit URL Category: coupon codes Show All Coupons

For those who make estimated federal tax payments, the first quarter ... Taxpayers can make an estimated tax payment by using IRS Direct Pay; Debit Card, Credit Card or Digital Wallet; or the Treasury Department's Electronic Federal Tax Payment System ( EFTPS ). If paying by check, taxpayers should be sure to make the check payable to the "United States Treasury."

About Form 1041-V, Payment Voucher - IRS tax forms Forms and Instructions About Form 1041-V, Payment Voucher About Form 1041-V, Payment Voucher Submit this voucher with your check or money order for any balance due on an estate's or trust's Form 1041. Current Revision Form 1041-V PDF Recent Developments None at this time. Other Items You May Find Useful All Form 1041-V Revisions

2019 Form 1040-V - IRS Form 1040-V. Department of the Treasury. Internal Revenue Service (99). Payment Voucher. ▷ Do not staple or attach this voucher to your payment or return.

IRS reminds taxpayers IRS Free File remains open until Nov. 17 IR-2022-199, November 15, 2022. WASHINGTON — The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free File remains open until November 17 and can help those who qualify claim the Child Tax Credit, Recovery Rebate Credit or Earned Income Tax Credit.. These and other tax benefits were expanded under last year's American Rescue Plan Act and ...

PDF 2022 Form 1040-V - IRS tax forms Payment Voucher. Do not staple or attach this voucher to your payment or return. Go to for payment options and information.

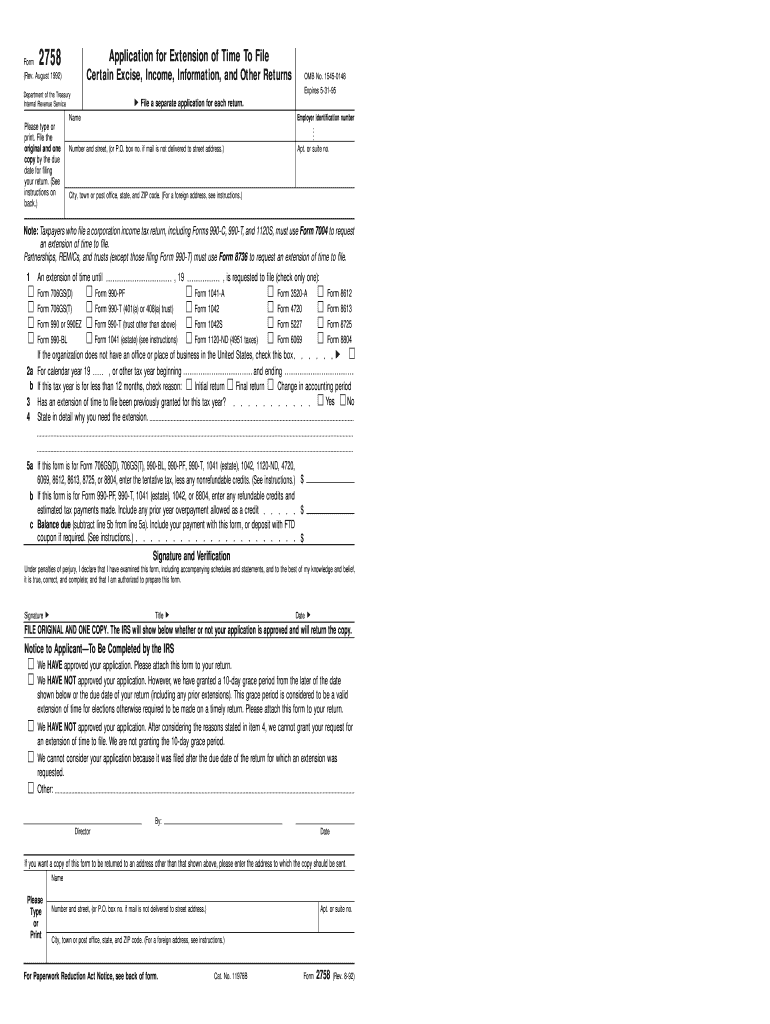

:max_bytes(150000):strip_icc()/taxextensionsfor2019and2020-8dcd5e625f194cf193880af9a3927dda.jpg)

Post a Comment for "39 payment coupon for irs"