43 is yield to maturity the same as coupon rate

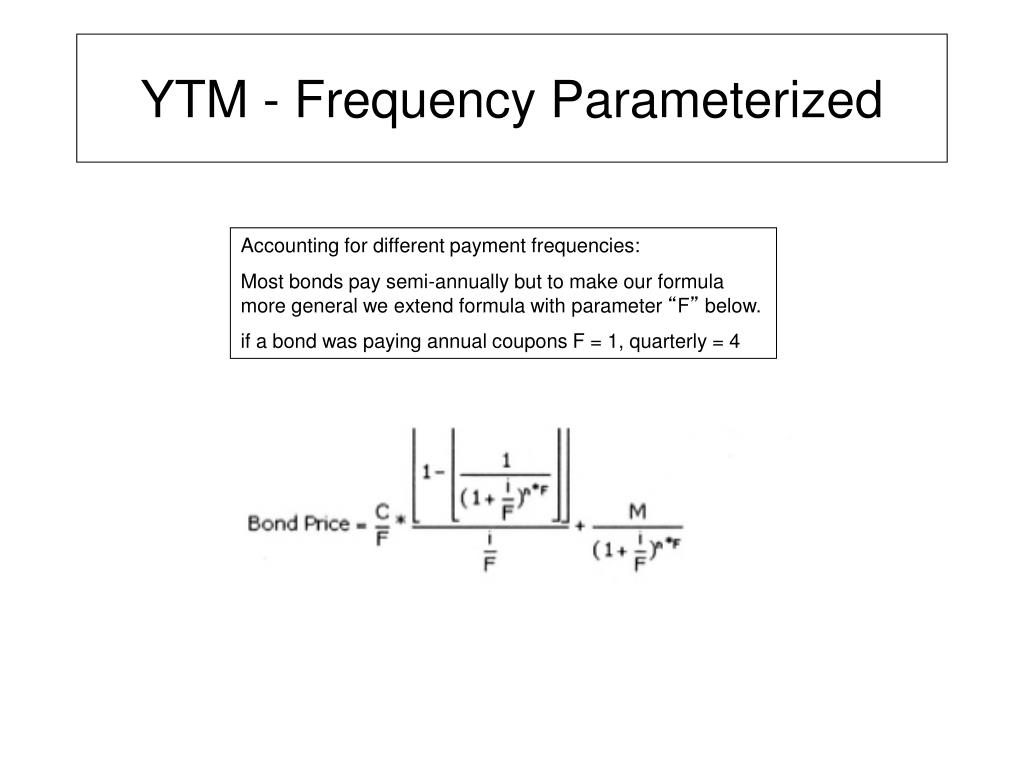

Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of...

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

Is yield to maturity the same as coupon rate

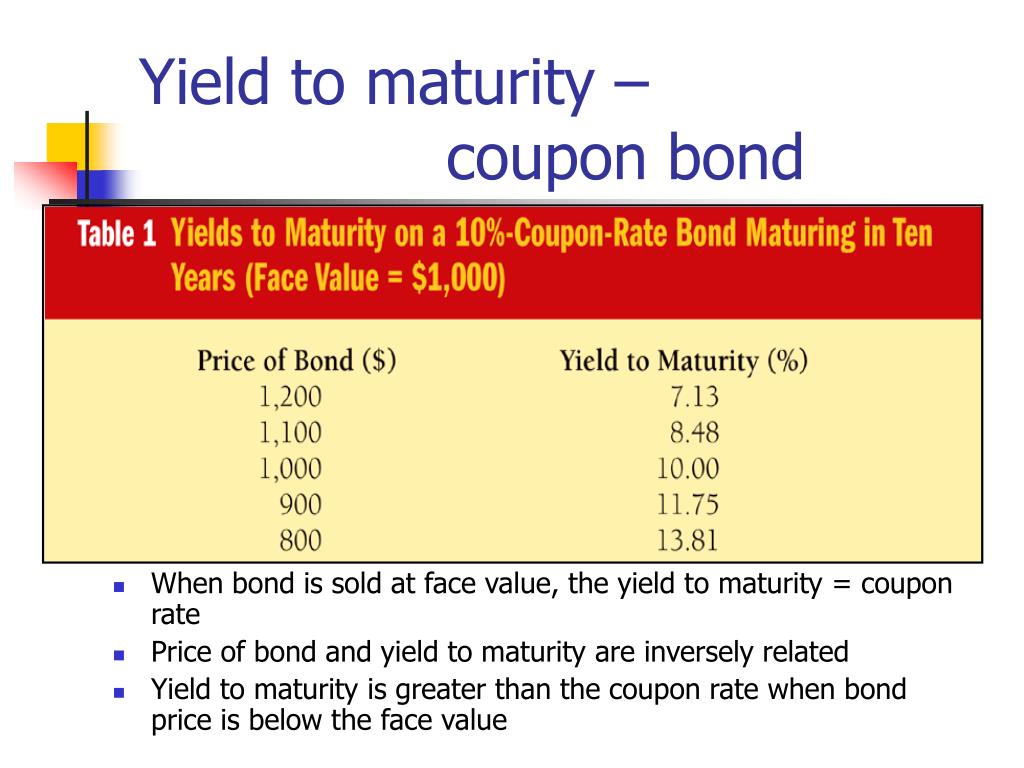

Coupon Rate - Meaning, Calculation and Importance Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. Yield To Maturity: What It Is And Why It's Important At that point, the yield to maturity is simply the coupon rate. However, this is rarely the case. Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment. It is a calculation measuring the cash flows starting with the purchase ... Yield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

Is yield to maturity the same as coupon rate. Yield to Maturity (YTM) Definition & Example ... The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... Understanding Coupon Rate and Yield to Maturity of Bonds ... The resulting YTM will differ from the coupon rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%. fin 300 Flashcards - Quizlet Bond J has a coupon rate of 4 percent. Bond S has a coupon rate of 14 percent. Both bonds have 10 years to maturity, make semiannual payments, and have a YTM of 8 percent. Solved Is the yield to maturity on a bond the same thing ... This problem has been solved! Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent.

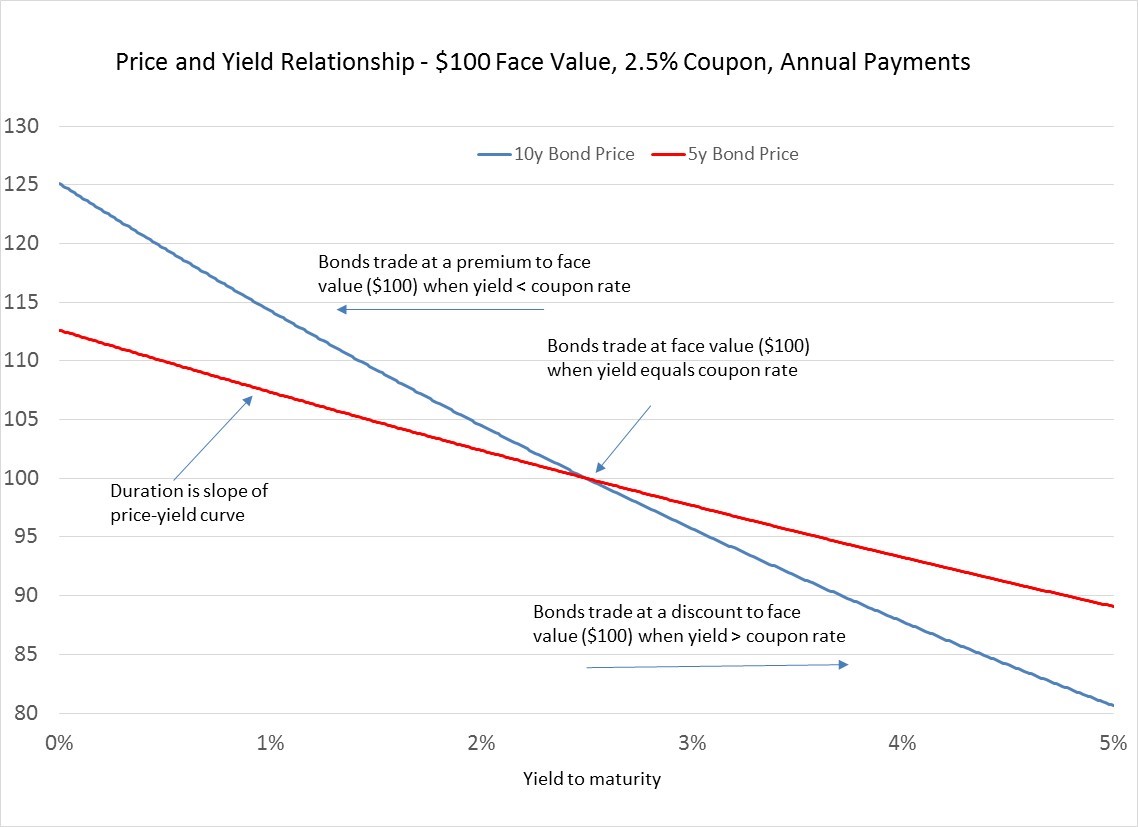

Basics Of Bonds - Maturity, Coupons And Yield As the price of a bond goes up, its yield goes down, and vice versa. If you buy a new bond at par and hold it to maturity, your current yield when the bond matures will be the same as the coupon yield. Yield-to-Maturity (YTM) is the rate of return you receive if you hold a bond to maturity and reinvest all the interest payments at the YTM rate ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Solved If the yield to maturity and the coupon rate are ... This problem has been solved! See the answer If the yield to maturity and the coupon rate are the same, then the bond should sell for ______. a. a premium b. a discount c. par value To answer enter a, b, or c. Submit Answer format: Text Expert Answer 100% (5 ratings) Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns.

Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Why is the yield to maturity of a bond equal to the coupon ... The yield to maturity is not necessarily equal to the coupon rate at the time of issue. That is only the case if the bond is sold at exactly face value, and the accrual period is the same as the payment period, which is not always the case. Many issuers set the coupon to be approximately equal to what they expect to be the market yield. What Is a Coupon Rate? How To Calculate Them & What They ... The difference between a yield to maturity and a coupon rate is: The YTM has an estimated rate of return which the buyer holds till its maturity date. When that happens, one can reinvest their profits with the same interest rate as before. The coupon rate is included in the YTM formula. FIN 221 Exam 1 Flashcards - Quizlet If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value. c. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of the bond's coupon rate. d. Answers b and c are both correct. e.

Difference Between Yield to Maturity and Coupon Rate ... The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1.

What is the effective annual yield formula? Effective yield is calculated by dividing the coupon payments by the current market value of the bond. return based on its annual coupon payments and current price, as opposed to the face value. Though similar, current yield doesn't assume coupon reinvestment, as effective yield does.

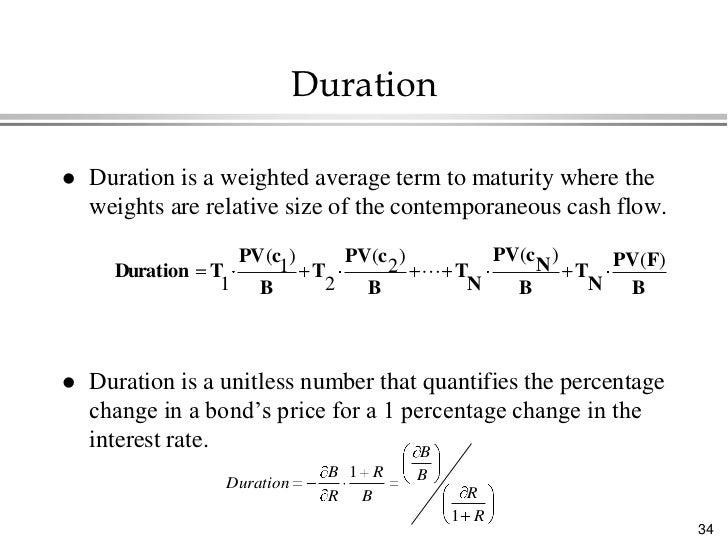

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon RateA coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Relationship Between Yield To Maturity And Coupon Rate People can find numerous relationship between yield to maturity and coupon rate options online to consider and shop at CountryDoor, using online coupon codes and discounts. Costco offers the best pet supplies to help you care for your pets; including grooming, dog beds, cat furniture, pet treats and health care.

Why do we use yield to maturity instead of coupon rate for ... Answer (1 of 4): Because the yield to maturity more consistently represents the cost of the debt. If a coupon bond is sold at par, and the coupons are paid, and then the bond is redeemed — both would be (almost) the same. Imagine (for example) a company issuing a bond that has a zero coupon, and...

Yield to Maturity vs Coupon Rate: What's the Difference ... While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Yield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than...

Yield To Maturity: What It Is And Why It's Important At that point, the yield to maturity is simply the coupon rate. However, this is rarely the case. Therefore, for the many times the market value doesn't equal the par value, the yield to maturity is the same as calculating the IRR(Internal Rate of Return) on any investment. It is a calculation measuring the cash flows starting with the purchase ...

Coupon Rate - Meaning, Calculation and Importance Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "43 is yield to maturity the same as coupon rate"